Regulatory Accounting Assistance Program (RAAP)

Making it easy for you to comply with the IRS card payment acceptance rule

Primary Feature:

Online Reconciliation: capability to view existing payment accounting and compare against gross payments reportable to the IRS

benefits:

- Explanation of computed amounts reported

- Reconciliation of paid versus reported sales for merchant tax return

- Integration with merchant online portal

- Information can be exported via Excel and imported to tax software if compatible

Important Dates:

- January 2016-December 2016. Data collected for year-end reporting

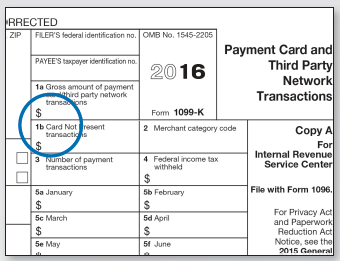

- January 2017. From 1099-K must be mailed to merchants by January 31, 2017

- March 2017. Merchant Forms must be filed with the IRS